Print

Email

ShareReprints

News Tip?

Get Alerts

Join the thousands of real estate professionals that subscribe to the New York AM Alert. Each and every morning, we deliver the important stories, data, analysis as well as the opinions and insights of industry thought leaders to provide you with market intelligence and a daily business advantage.

Become a registered member today and dont miss another important story in the New York market. Let GlobeSt.com be your source for everything real estate.

At GlobeSt.com, we are passionate about bringing you the best possible user experience. We listened to your feedback and now offer the ability to access information on GlobeSt.com without interruptions! Supercharge your viewing experience by disabling these ads.

Parker says Greenpoint, Buswick

and Long Island City are “very strong”

for multifamily investment.

NEW YORK CITY-Manhattan, Brooklyn and Queens are continuing to attract institutional as well as foreign capital – and J.D. Parker, vice president and regional manager of the Manhattan office of Marcus Millichap, predicts between $35 to $40 billion in overall sales volume this year. He talked with GlobeSt.com about what’s in-store for the five boroughs within the coming months.

GlobeSt.com: The NYC investment sales market appears to be holding steady. What is your outlook for the remainder of the year?

Parker: I think it’s going to continue to hold steady, and I think there will be an increase in the overall market and velocity expected to pick up a little bit throughout the year. There are still some significant supply and demand issues in the market that allow New York City to be clearly the best market in the country. Rents have gone up across the board across all product types over the last 12 months. I expect it to continue have strength and there’s a significant amount of demand in the market right now. I expect an increase in overall transaction velocity from 2011, which is right around $25.5 billion and $26 billion in sales. My estimate would probably be in the $30 to $35 billion range, maybe $40 billion range. I think there will be an increase by the end of the year.

GlobeSt.com: Do you believe the flight-to-quality trend will continue, or are investors starting to look beyond core?

Parker: In Manhattan, it’s a bit of both. People are still really chasing core properties, driving down cap rates from record highs, if not setting new records. And then investors are going after secondary and tertiary locations in Manhattan that really weren’t for the two or three years of the downturn. So across the board it is getting compressed. Prices are going up and cap rates are getting compressed. A lot of people believe that interest rates are going to go up toward the end of the year, if not sooner. Treasuries have already gone up significantly in the last three weeks, as the economy continues to have shades of recovery. If the Fed makes a move and raises rates, I think that’ll be a sign of strength and people will continue to buy aggressively because they are going to want to lock-in on mortgages for a longer period of time.

GlobeSt.com: Are smaller properties showing promise?

Parker: They are, and there’s new investors coming into the marketplace that haven’t been there. A lot of people like small buildings because there are lower taxes, and the smallest buildings are typically a protected tax class, so they are exempt from the significant increases that large commercial buildings will see. But it’s become a very accepted form of alternative investment for wealthy people in the marketplace. You are seeing a really, really strong appetite for small buildings across all five boroughs.

GlobeSt.com: After dropping off years ago, grocery- and drugstore-anchored retail are hot again in the NNN space. What market factors are driving that?

Parker: It definitely slowed down a little bit, but it never really stopped some of the products we work on. But it’s been a product of strength. It’s definitely come back to life, and it’s the same reasons why people were buying that type of property before the downturn. The absence of management has worked out very favorably by owners that are sick of dealing with tenants, so these properties are typically long-term leases with no management or little management responsibility, and that’s a very attractive opportunity. I represent a lot of owners throughout the region that are selling their apartment buildings and then buying something with reduced management responsibilities to have a better lifestyle. We represent a lot of owners this year and last year and many years where they sell an apartment building for 3.5%, 4.5% or a 5% cap and they can buy a property within 200 miles of the city at a 7%, 8% or even a 9% return, they can significantly their cash flow and reduce their management expenses because of that cap rate arbitrage that you could play if you go off the Island of Manhattan.

GlobeSt.com: What are the best neighborhoods for multifamily investment right now?

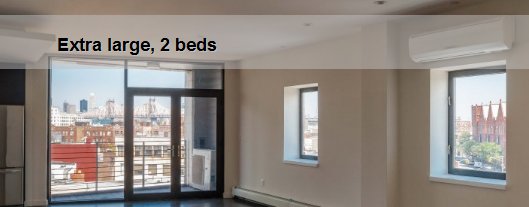

Parker: Anything that is seeing rapid gentrification or tenancy changes. Greenpoint, Bushwick and Long Island City has been very, very strong over the last 12 months. And then obviously there’s the bellwether like Brooklyn Heights, Park Slope, Astoria and pockets around Manhattan that have been very strong, but those neighborhoods have seen significant growth in the last five years, and we expect those neighborhoods to continue to change and property values will rise because of it. In the city, certainly the Far West Side has seen a lot of development and condo projects and also new rental projects. There’s a lot of life over there, and rents are very strong.

GlobeSt.com: What sector is showing the strongest improvement in overall sales and why?

Parker: Overall, multifamily is the strongest property type in terms of demand. People view it as a tremendously safe asset in New York, predominantly in the best neighborhoods in Brooklyn, Queens and Manhattan. It is really almost viewed as a bond because of its strength and safeness. Because there’s a lack of supply, I would predict that rents would grow very strongly by the end of the year.

For more thought leadership from Marcus Millichap Real Estate Investment Services, check out “StreetSmart,” a blog by Hessam Nadji, the firm’s managing director of research and advisory services. The blog provides Thought Leadership positions on a variety of commercial real estate-related issues. Click here to watch Nadji on CNBC’s “Realty Check” program talking about multifamily and the housing crash. For more information on the Thought Leadership program, contact Scott Thompson at [email protected].

Categories:

Northeast,

Multifamily,

Office,

Retail,

Acquisitions/Dispositions,

Capital Markets,

Marcus Millichap,

New York

Jacqueline Hlavenka Jacqueline Hlavenka, Northeast Region Reporter for GlobeSt.com and Real Estate Forum, is responsible for coverage of news and information pertaining to commercial real estate in New York City. Prior to joining ALM, she served as a municipal beat reporter for Greater Media Newspapers in central New Jersey. Her work has also been published in The Asbury Park Press, The Village Voice, Interior Design Magazine and Condé Nasts Cookie Magazine. Contact Jacqueline Hlavenka.